Calculator

Saving for Retirement

Tips on Saving for Retirement – While these tips are helpful, there are numerous factors that come into play when planning for retirement. Make sure you ask questions, lots of questions, and most importantly make sure you understand the answers.

If you are already saving for retirement, go ahead and save some more! If you’re not saving, it’s time to get started. The sooner you start saving, the more time your money has to grow.

If you are already saving for retirement, go ahead and save some more! If you’re not saving, it’s time to get started. The sooner you start saving, the more time your money has to grow.

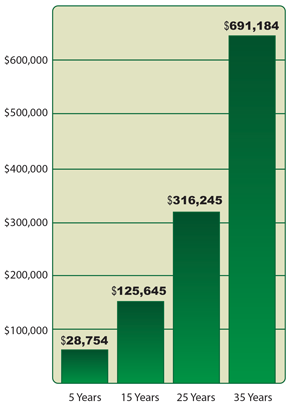

The sooner you start saving, the more time your money has to grow. Check out the chart that illustrates how big of an impact early savings habits can have. Remember, it’s never too early or too late to start saving.

Start Saving Early – This hypothetical example illustrates your savings growth based on saving $5,000 every year with an interest yield of 7% annually.

Source: http://www.dol.gov/ebsa/images/top10ways2.jpg

A common calculation for determining how much money you’ll need in retirement is roughly 70% of your pre-retirement income. Now this can fluctuate depending on many factors like; will your mortgage be paid off by the time you retire? Will your lifestyle change once retired, will you travel more? Be realistic and review your current expenses and determine how they’ll change once you’ve entered retirement.

Knowing all of the savings options that are available to you allows you to optimize the ways you can save for retirement. Find out if your employer has a traditional pension plan, and if so what are those benefits. If your employer offers a savings retirement plan like a 401(k), make sure you’re contributing enough to get the full company match. There are also many strategies on when and how to claim your Social Security benefi ts. You can calculate your benefit amount on www.SocialSecurity.gov. The more you know, the more you can plan.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG, LLC, to provide information on a topic that may be of interest. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.