How to stretch your dollars during inflation

9.1%.

That’s the average annual inflation rate for the US as of June 2022, the worst increase in 40 years.

Is there an end in sight? It’s hard to say, even though the government is raising the interest rates to cool off the soaring prices.

But what do these statistics and policies mean for you? What’s your personal inflation rate?

At 9.1%, you could be spending almost $1 more for every $10 you spent last year. If you’re a retiree on a fixed income, those dollars add up quickly. If you’re still working and got a nice raise, that raise might not actually keep up with what you need. Certain items prices have risen much, much more than 9.1%.

The good news is that other prices have increased less steeply.

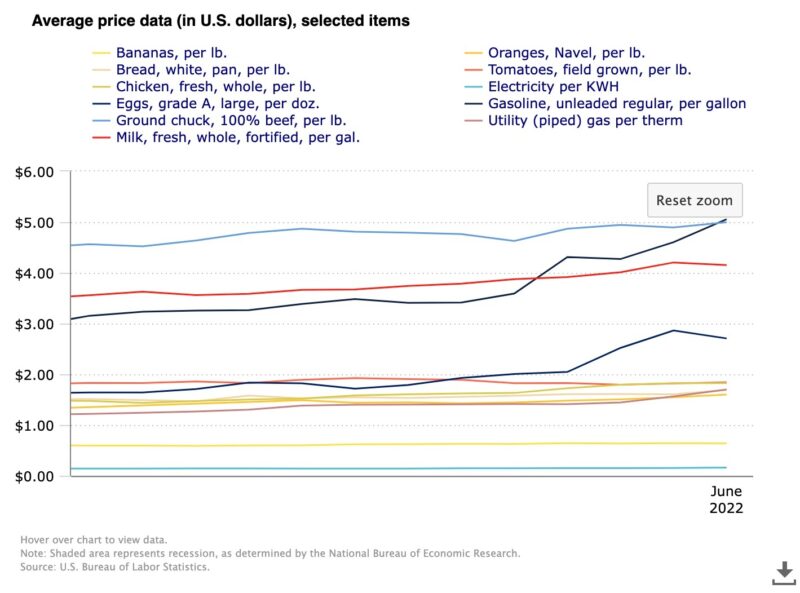

The U.S. Bureau of Labor Statistics put together the following chart that shows comparative prices from June 2021 to June 2022. Some prices are almost flat, believe it or not!

Here’s a few tips to help you make the most of the situation and keep your personal inflation rate down by checking on the sharpest price spikes.

Eat your veggies

The average cost of groceries has risen an uncomfortable 12.2% over the 12 months previous to June 2022.

But not all foods are created equal.

Fruits and vegetables have only (‘only’) risen 8.1%–below the overall national inflation average. And it’s the only food group below a 10% increase.

Hard to swallow for carnivores?

The meat and poultry group did slightly decrease during June, so you might see some better prices there than you did in May. But if you’ve been telling yourself that you need to eat more fruits and vegetables, the inflation rate may be the final nudge you need.

According to the average price data from the US Bureau of Labor Statistics, it’s a good time for healthy meals and snacks. Bananas have risen only $0.04/lb, and tomatoes only $0.01/lb. Meanwhile, you might be paying $1.07 more for every dozen eggs or $0.36/lb more for a whole chicken.

This can be your motivation to replace some of your snacks with a fresh option and experiment with new recipes – all while keeping your grocery bill down.

Avoid major offenders: car and gas prices

The less said about the bloodbath at the gas pumps, the better. Fuel oil costs have increased 98.5% from June 2021 to June 2022 (after spiking higher than that in May). Even if you only drive infrequently, you’ve noticed.

Your lifestyle may help you avoid the rates. If you no longer commute or can work from home most days, that’s one way to save. And certain neighborhoods make walking or biking feasible options.

But not everyone has those options.

There are a few things everyone can do, however:

- Combine errands: The slow, stop-and-go traffic of local trips is a major gas drainer. Take a little extra time to see what other errands you need to do soon and tackle as many as you can on the same trips out.

- Make a list and check it twice: Whether you’re picking up groceries or household goods, it’s frustrating to return home and find you’ve forgotten one key item. Don’t set yourself up for multiple trips a week. Having a written list—physically or digitally—will help your memory.

- Watch your speed: Some people might like to go well above the speed limit on the highway, but top fuel efficiency is actually around 50 mph (sorry, speedsters). The more often you can safely drive close to that speed, the more mileage you’ll get from your tank.

AAA has many other useful tips, and don’t forget to check local prices to see if there’s a cheaper station around you.

But it’s not just gas efficiency you need to watch out for.

New and used vehicles are also seeing a steep price bump. June numbers show that new vehicles cost on average 11.4% more this year than last, and used cars and trucks 7.1%.

If you aren’t already getting regular maintenance and trying to keep your car clean, inside and out, now may be a good time to start those habits. Getting a few more years out of your car can save you thousands right now. AAA recommends you take a look at your car monthly and be vigilant about any changes – don’t leave that dash light on forever!

Take advantage of secondhand stores

There are over 25,000 consignment and resale stores in America. If you don’t regularly visit thrift stores, why not find your local one now?

If for some reason you’re hesitant to go and have never been to one, know that according to America’s Research Group, more Americans shop at a thrift store or consignment store than outlet malls annually. Almost as many people visit secondhand stores annually as regular apparel or department stores.

People love thrift stores, and why shouldn’t they?

- Prices are nothing compared to new products.

- It helps with waste–fewer objects end up in the landfill.

- Many thrift stores are nonprofits and help good causes with their earnings.

- You can find some unique and interesting items.

- These stores regularly have sales on top of their regular low prices—plan trips around storewide deals!

Thrifting might not work if you need a particular brand or item, but if you’re patient and open to different styles, there are figurative treasures. The nation’s inflation rate may be 9.1%, but you could be paying 50% less for items that are new to you and can be used for many years.

National Inflation Rate versus Your Inflation Rate

The personal cost of inflation varies by household. Child costs, pet care, entertainment, travel – these are all items that might be zero in one household and thousands in another.

But whether your personal inflation rate is above or below the national average calculated by the Consumer Price Index (CPI), there are some steps to take to keep it in check.

It’s also a good time to speak to a financial planner. If you have trouble making a budget or are worried about current spending affecting your retirement goals, a financial planner will work with you to look at your lifestyle, goals, and savings to see whether you’re on track.

Nobody knows whether inflation will keep rising and surpass the 13.3% from 1979. It’s up to us to think outside the box and weather the storm.

So comment and let us know your favorite way to save in 2022.